What Is an HSA (Health Savings Account) and Should You Be Utilizing?

Written by: Brad Meyers

HSA’s (Health Savings Accounts) were first enacted in 2003 to help reduce the employer expenses for group health benefits and also make healthcare more affordable for employees. Employee participants have flexibility of investment options for unused contributions that roll over each year as well as flexibility of withdrawals.

How do you set one up?

HSA’s require a high deductible insurance plan, specifically, $1,350 for individuals and $2,700 for families. Typically you’ll set up the insurance through your employer and once you have over $1,000 in your HSA you can open up a separate account where you can manage your investments. The contributions will come directly out of your paycheck and your employer will often contribute to your HSA annually, similar to a match on a 401k. In general, these health savings accounts are more beneficial for a healthy individual/family who will use less of the contributions on an annual basis and allow the funds to stay invested and grow.

What is the tax benefit?

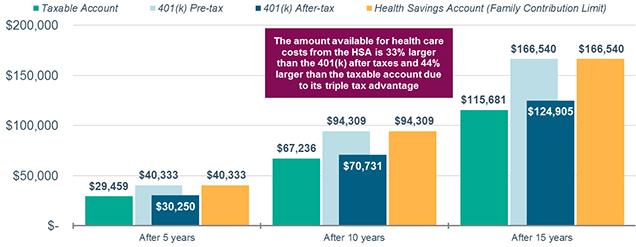

An HSA has a triple tax benefit. First, the contributions (maximum of $3,550 for individuals and $7,100 for families) are deducted from your gross income. Second, once the funds are in the account, they will grow tax deferred. And third, withdrawals that are used for qualified medical expenses are tax free. The contributions remain in your account until you use them and are also portable if you change employers. Those over age 55 will be able to use a catch up contribution of $1,000. After the age of 65, participants may use any unused HSA assets for non-qualified medical expenses without penalty. You will have to pay taxes on the amount withdrawn much like a 401k.

The HSA is one of the few opportunities W-2 physician employees have to reduce their taxable income. By investing $7,100 in an HSA, a family can save $2,485 in taxes assuming a 35% tax bracket. Instead of using post tax money from your checking account, you’re able to save money up front with a contribution and then on the back end when used for qualified medical expenses.

When do I have to take distributions?

Unlike IRA’s, there are no required minimum distributions (RMD’s) at age 72. However, it’s usually a good idea for you or your spouse to use the funds for qualified medical expenses during life because beneficiaries will be taxed at the fair market value of the HSA in the year of death.

How much should I plan to save?

According to a Fidelity study, a 65 year old couple retiring in 2019 can expect to spend $285,000 in healthcare and medical expenses throughout retirement. For single retirees, the health care cost estimate is $150,000 for women and $135,000 for men. If you can afford to pay out of pocket on expenses and let the invested funds grow, you have a lot more potential for compound interest to take effect.

Source: Schwab Center for Financial Research. The chart is for illustrative purposes only. Assumes $5,000 in annual after-tax contributions to a taxable account, or $6,750 in annual pre-tax contributions to a 401(k) or HSA account. $6,750 is the maximum contribution allowed for an eligible individual or any other person with family high-deductible health plan coverage combined with an HSA in 2017. The limit for self-only coverage combined with an HSA in 2017 is $3,400, so the numbers in the yellow shaded boxes would be substantially lower. Assumes annual investment growth of 6% in a diversified portfolio that is 60% stocks and 40% bonds and cash, a 15% long-term capital gains tax annually on earnings in the taxable account, a 25% tax on distributions from the 401(k) and no tax on distributions from the HSA account for qualified health care costs. In practice, you shouldn’t invest HSA funds needed to pay for two to three years of potential out-of-pocket healthcare costs. Past performance is no guarantee of future results.

[bctt tweet=”With an HSA, A 35-Year-Old Couple Today Can Potentially Save $285,000 in 30 Years by Investing $2,820 Annually.” username=”25financial”]

Why is it sometimes referred to as a stealth IRA?

For higher income earners, you may be phased out of taking tax deductions on IRA contributions if you make over $206,000. There are no income limitations or phase outs on deducting HSA contributions from your gross income! Higher earners should consider this strategy to pull back your taxable income. Some similarities to traditional IRA’s include taking a tax deduction up front (provided you aren’t over the income limitations) and deferring the growth until you are age 59 ½. With IRA’s you are required to take RMD’s at age 72. As mentioned, HSA’s do not require RMD’s. Furthermore, at age 65 there is no longer a hefty 20% penalty to use the funds you’ve accrued on anything you like beyond medical expenses. You’ll just be required to pay the ordinary income taxes that you would have paid with an IRA distribution, but with the idea that you’ll be saving money in taxes in your higher earning years and then taking distributions in your lower earning years in a lower tax bracket.

Can I roll over funds from an IRA to use for medical expenses?

Yes, you can only roll funds from an IRA to an HSA once during your lifetime. The maximum rollover cannot exceed the annual HSA contribution limit for that year. If you have medical expenses piling up and can’t afford to pay out of pocket, this may be a strategy to implement. However, be advised that you will be required during the “testing period” to remain in your high deductible health plan for twelve months following the transfer. Otherwise you’ll need to pay ordinary income taxes on the rollover along with a 10% penalty. Another note to mention, a rollover from a traditional IRA would be much more beneficial than a Roth IRA since you’re moving pre-tax dollars that you’ll be able to pay for qualified medical expenses tax free.

If you are in high income brackets, this is a great opportunity to take advantage of a tax deduction especially for a W-2 employee because there aren’t many out there. Max the HSA up to contribution limits each year, invest the funds, & let them accrue while paying for medical expenses out of pocket in order to let the investments grow tax free. Keep a detailed account of expenses/receipts and you can reimburse at a later date after allowing your funds to grow tax free.

Read more investment insights about financial planning for physicians or alternative investment funds.

Important Information:

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purposes of making an investment decision or otherwise. 25 and Arete Wealth Management are not tax professionals. You should consult with your tax professional before taking actions which affect your tax situation.

Securities offered through Arete Wealth Management, LLC, member FINRA, SIPC and NFA. Investment advisory services offered through Arete Wealth Advisors, LLC, an SEC Registered Investment Advisor.