3 Investment Opportunities From The Coronavirus Related Distribution (CRD) Provision Under CARES Act

Written by: Randy Larson, J.D., LL.M., CFP®

25 Executive Summary:

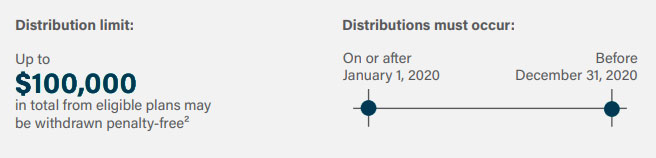

Under the CARES Act, all eligible participants can withdraw up to $100k with no 10% penalty or tax withholding from their IRAs and employer-sponsored retirement plans, each called a Coronavirus Related Distribution (CRD). Participants can spread the tax burden from this Coronavirus Related Distribution evenly over 3 years (2020, 2021 and 2022) or elect to be taxed all in 2020 (perhaps if your income is lower given Covid-19).

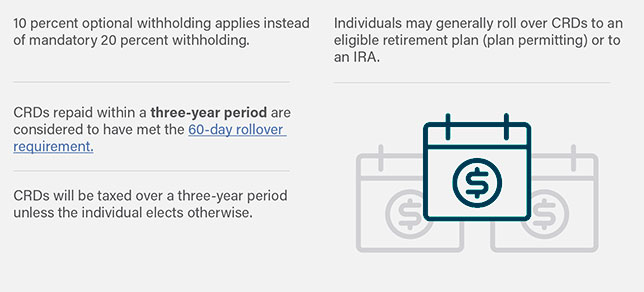

Alternatively, participants can avoid all taxes on the distribution by simply repaying a retirement account incrementally or as a lump sum within 3 years. This repayment will be treated the same as a qualified plan rollover within the 60 day window.

The Coronavirus Related Distribution offers Three Investment Opportunities for Physicians & High Net Worth Investors

1. Better Investments Options. Physicians and HNWs can withdraw $100k from their 401k and roll it into a rollover IRA in order to gain access to a broader range of investment options. This might be a good opportunity to invest in non-correlated alternative investments that are not allowed in most employer-sponsored retirement plans.

2. Generate Tax Deductions. Physicians and HNWs can withdraw $100k and invest in a tax-favored alternative investment such as an oil and/or natural gas partnership with first-year Intangible Drilling Cost (“IDC”) deductions. Some alternative investment companies offer as much as 80% of the original investment as a deduction in the first year. IDC deductions are “above the line” and therefore reductions of the taxpayer’s gross income under section IRC 263(c).

In this case, if an accredited investor invests $100k in a natural gas partnership with 80% IDC deductions, they will reduce their gross income by $80k and enjoy significant tax savings in 2020.

3. Roth Conversion Strategy. Physicians and HNWs can convert pre-tax IRA money to a Roth and use the 100k distribution to pay the taxes on this conversion. At a 40% tax bracket, $100k can leverage a $250k conversion to grow tax-free. Not only is this an ideal Roth conversion environment, there is the added benefit of using the full $100k now but spreading the repayment evenly over 3 years.

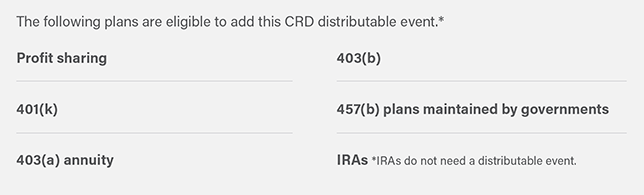

Eligible Plan Types

Rules and Timeline

Distribution must be made by:

A qualified individual, defined as an individual who is diagnosed with the COVID-19 or SARS CoV-2 (or whose spouse or dependent is diagnosed with the virus) in an approved test.

OR

An individual who experience related adverse financial consequences.

Impact on Employers

- Employers can rely on individuals’ certification that they meet the requirements.

- Employers adding a CRD distributable event to their plan will need to amend their plan document by the end of their 2022 plan year to document this change.

- Employers are not required to offer the direct rollover option or provide the required 402(f) notice that explains rollover options

Tax and Rollover Treatment

¹ Individuals who have other coronavirus related distribution events in eligible plans, defined benefit plans, and money purchase pension plans can still take advantage of these tax benefits, even if the employer hasn’t authorized a CRD distributable event.

² Individuals in eligible plans, defined benefit plans, and money purchase pension plans may distribute up to $100,000 (in aggregate) from their vested account balance.

Important Information:

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purposes of making an investment decision or otherwise. 25 and Arete Wealth Management are not tax professionals. You should consult with your tax professional before taking actions which affect your tax situation

Securities offered through Arete Wealth Management, LLC, member FINRA, SIPC and NFA. Investment advisory services offered through Arete Wealth Advisors, LLC, an SEC Registered Investment Advisor