CARES Act: 5 Key Takeaways for Physicians and High Net Worth Taxpayers

CARES Act: 5 Key Takeaways for Physicians & High Net Worth Taxpayers

Written by: Randy Larson, J.D., LL.M., CFP®

On March 25, 2020, the Senate unanimously passed (96-0) the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) followed by the House of Representatives who passed the CARES Act by voice vote on March 27, 2020. President Trump signed the bill into law that same day.

Here are some key points from this nearly 900-page legislation:

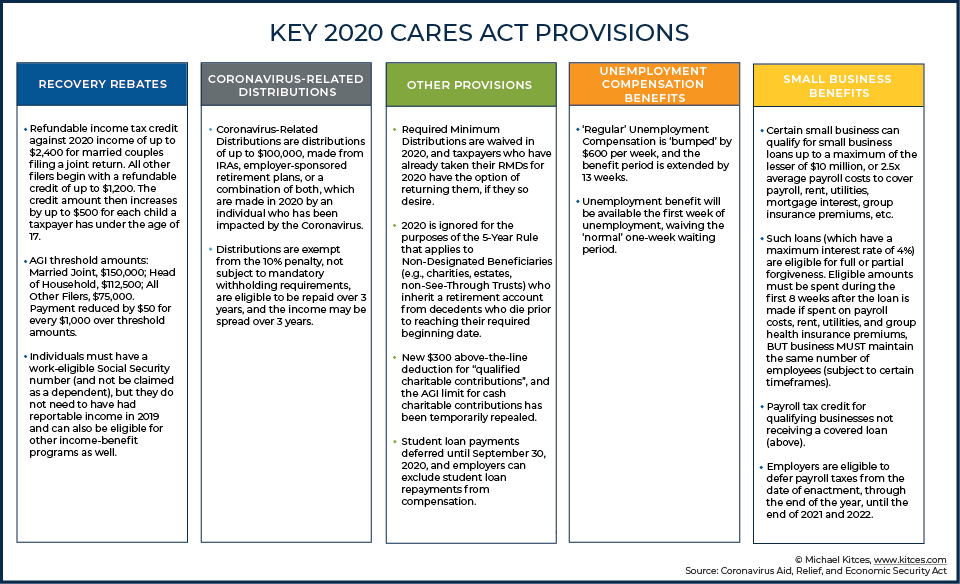

The CARES Act provides stimulus to individuals, businesses, and hospitals in response to the economic distress caused by the coronavirus (COVID-19) pandemic. Here is the breakdown:

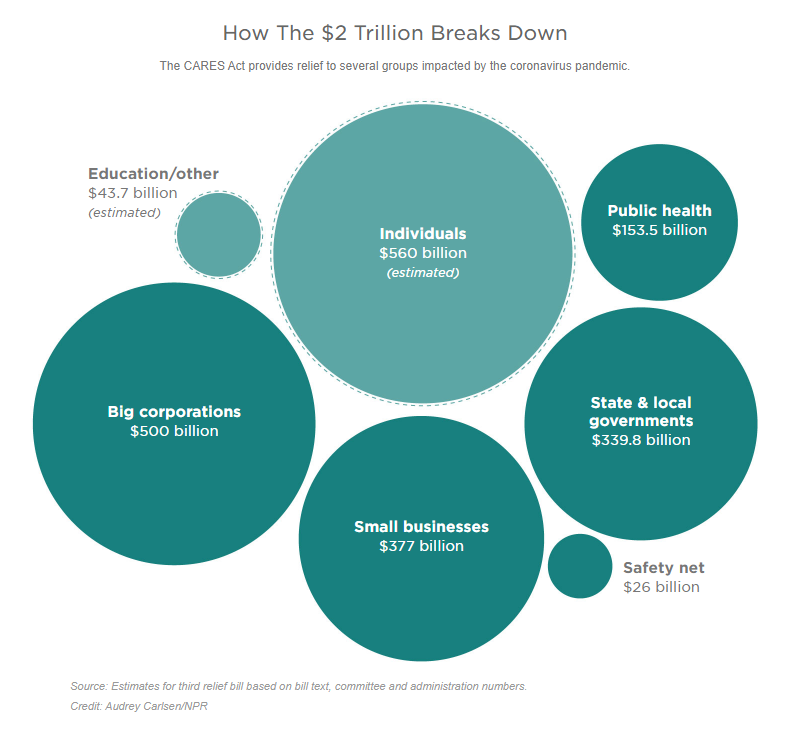

Perhaps the most popular provision of the CARES Act is the “Recovery Rebate” (checks to individuals) from which (approximately) 90% of Taxpayers will receive at least some cash benefit. This graph helps understand the rebate:

Many Doctors and other High Net Worth (“HNW”) taxpayers will not be eligible for the recovery rebate and other provisions in the CARES Act.

5 Provisions That Should Be Closely Examined by HNW Taxpayers

1. No RMDs for 2020

The CARES Act waives Required Minimum Distributions (“RMDs”) for 2020. HNW retirees might consider forgoing this distribution for 2020 for several reasons. To begin, many HNWs do not need this distribution for lifestyle expenses and find RMDs to be a major hindrance to maintaining lower tax brackets during retirement. Furthermore, 2020 RMDs would be based on a December 31, 2019 inflated value (after a decade-long bull run in domestic markets) only to force liquidations at an inopportune time before the markets have time to recover.

What if I have already taken my RMD for 2020?

If a retirement account owner has already taken their distribution in 2020 and would like to return it, there are 2 options to return the distribution: They can simply send the money back if they are within the 60 days. Or, if they withdrew their RMD longer than 60 days ago, they can send the amount back to the plan if they fall under the liberal “Coronavirus-Related Distribution” requirements listed below. Under these rules, they would have 3 years from the distribution to send the check back to the plan.

![]()

Without the RMD increasing tax brackets for 2020, HNW’s might consider Roth conversions from pre-tax accounts of a similar amount as the RMD would have been. The tax burden would be the same as taking the RMD and the conversion would be of discounted stocks that will (presumably) recover but will now grow tax-free in a Roth IRA.

2. Coronavirus-Related Distribution (“CVD”) from Qualified Plan

All eligible participants can withdraw up to 100k per individual with no 10% penalty or (usually minimum of 20%) Federal withholding from their IRA’s and employer-sponsored retirement plans. You can spread the tax burden from this distribution evenly over 3 years (2020, 2021 and 2022) or elect to be taxed all in 2020 (perhaps if your income is lower given Covid-19 impact on your income).

Alternatively, you can avoid this tax by simply repaying a retirement account within 3 years incrementally or as a lump sum. This repayment will be treated the same as a rollover between qualified accounts. In order to be eligible, an individual must have been impacted by the Coronavirus because they:

Have been diagnosed with COVID-19; Have a spouse or dependent who has been diagnosed with COVID-19; Experience adverse financial consequences as a result of being quarantined, furloughed, being laid off, or having work hours reduced because of the disease; Are unable to work because they lack childcare as a result of the disease; Own a business that has closed or operate under reduced hours because of the disease; or Meet some other reason that the IRS decides to say is OK.

![]()

- Eligible participants might consider withdrawing 100k from their 401k and rolling it into a rollover IRA in order to gain access to a broader range of investment options than the limited 401k options.

- Some professionals have suggested rolling the 100k directly into a Roth IRA. Others have suggested that this will be seen as an excessive contribution (exceeding 6k annual contribution limits to Roth IRAs). Time will tell whether this strategy works.

- Two alternative options to rolling the 100k directly to a Roth:

- Simply convert pre-tax IRA money to a Roth and use the 100k distribution to pay the taxes on this conversion and then spread the tax payment of the 100k over 3 years. At a 50% tax bracket, 100k will cover the taxes on a 200k conversion. In addition to the reasons stated above that this is an ideal Roth conversion environment, there is also the benefit of using the full 100k now but spreading the repayment evenly over 3 years.

- HNWs (Accredited Investors only) can use the 100k towards a tax favored alternative investment such as an oil and/or natural gas limited partnership investment with first-year Intangible Drilling Cost (“IDC”) deductions. Some alternative investment companies offer as much as 80% of the original investment as a deduction in the first year. IDC deductions are “above the line” and therefore reductions of the taxpayer’s gross income. In this case, if an accredited investor invested 100k in an oil/gas limited partnership with 80% IDC deductions, they can pull back their gross income by 80k and therefore save 32k in taxes (at a 40% tax rate) in 2020. Alternatively, they could convert 80k from a rollover IRA to a Roth and eliminate that increase in gross income by investing the 100k CVD in an oil/gas partnership that reduces his gross income by 80k in that same year.

3. Student Loans

All Federal Student Loan payments will be suspended without the accrual of interest through September 30, 2020. The bill does not affect private loans. When a borrower refinances a federal loan with SoFi, they obtain a private loan, and are no longer a federal loan borrower. This will apply automatically but going to take a few weeks. Additionally, employers may contribute up to $5,250 to employees’ student loans tax-free to the employee through 2020. This was previously taxed as ordinary income.

4. Charitable Contributions

There are two noteworthy changes to charitable contributions in CARES. First, taxpayers may take an above-the-line tax deduction for charitable cash contributions of up to $300 for the tax year beginning in 2020. This is obviously not a large amount of money, but since it is “above-the-line” deduction, it means that all taxpayers can deduct this amount even if they do not itemize (90% of taxpayers do not itemize but claim the standard deduction).

![]()

For highly paid doctors in the 37% tax bracket, this is $111 tax savings. Consider gifting $300 to a favorite charity when they likely need it the most and receive about $100 back on your taxes in 2020. This provision (accidentally?) does not have a sunset provision and so therefore, as written, might be permanent. Keep your eyes open for this strategy for 2021 and beyond.

Second, CARES suspends the 60% of your AGI cap for cash charitable contributions. This means you can completely wipe your income out for 2020 by giving away 100% of your income. In fact, you can give away more than your income and carry over the charitable deductions up to 5 years.

5. Small Business Benefits

Many Physicians and other HNW business owners are looking for temporary relief. CARES act offers 2 programs: the Economic Injury Disaster Loans / Grants (EIDL) and the Payment Protection Act (PPP). Business owners may only participate in one of the two programs.

The EIDL is offered exclusively through the SBA (www.SBA.gov). This is loan is up to 2M amortized over 30 years but requires collateral or a personal guarantee. The loan is for 3.75% and includes a grant of 10k within days of approval.

The PPP is a unsecured and uncollateralized loan for 2.5x the average total monthly payroll (capped at $100k/person) over the last 12 months (from either March 1st or February 15 2020, borrower’s choice) with under 4% interest rate. Some CPAs claim borrowers may include officer/owner’s salary up to 100k in this calculation. Borrowers must make a good faith certification that: the loan is necessary to support the business through environment created by COVID-19 and that funds will be used to retain workers and maintain payroll or make mortgage interest payments, lease payments and utility payments.

A borrower of a PPP loan is eligible for loan forgiveness for amounts spent during the 8-week period (i) rent, (ii) defined payroll costs, (iii) mortgage interest, and (iv) utilities, not to exceed the principal of the loan. The amount of the PPP loan forgiveness may be reduced if the borrower reduces the number of employees or salaries and wages (for employees with annual salaries less than $100,000) during the 8-week period following the origination of the loan. However, this reduction penalty doesn’t apply to the extent the borrower restores their workforce count and salaries/wages by June 30, 2020.

Small businesses can apply April 3, 2020 and independent contractors and self-employed individuals can apply April 10, 2020. Check with your SBA approved lender or banker for more details.

Additionally, small businesses can defer payroll taxes until end of 2020: Half of this deferred amount would be due on December 31, 2021 and the other half by December 31, 2022.

If you have questions about CARES and how it impacts you, contact one of our advisors.

Important Information:

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purposes of making an investment decision or otherwise. 25 and Arete Wealth Management are not tax professional. You should consult with your tax professional before taking actions which affect you tax situation.

Securities offered through Arete Wealth Management, LLC, member FINRA, SIPC and NFA. Investment advisory services offered through Arete Wealth Advisors, LLC, an SEC Registered Investment Advisor.