Outrun Investors with Disciplined Investing

I have known a great deal of trouble in my life but most of it never happened.

– Winston Churchill –

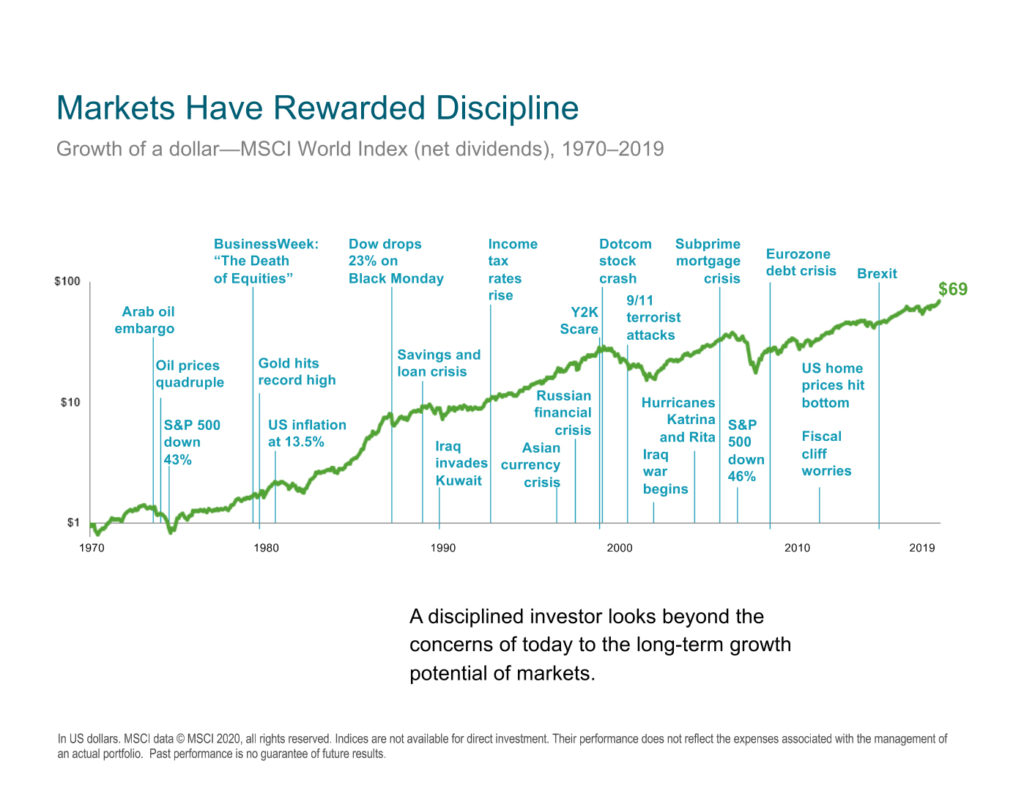

Although there continues to be a tremendous amount of uncertainty in the markets and world economies, our clients have a competitive advantage over other investors during volatile markets by maintaining disciplined investing. It reminds me of the joke about fictitious “Steve” and “Mark” who were camping when a bear emerged from the woods and growled. Steve immediately started putting on his tennis shoes when Mark yelled, “What are you doing? You can’t outrun a bear!” Steve replied, “I don’t have to outrun the bear—I just have to outrun you!”

Beat the Camper Not the Bear

Similarly, our goal is not to avoid “bear” markets and risk altogether. That is impossible (even holding cash carries inflation risk). Instead, a free market economy is built on competition. Companies compete to make products or services faster and cheaper and investors compete against each other for the most efficient financial participation in these companies (i.e. Shark Tank). The goal for investors, therefore, is to get the most reward for the risk that they are taking with their investments. And this often means “outrunning” the competition in bear (and bull) markets.

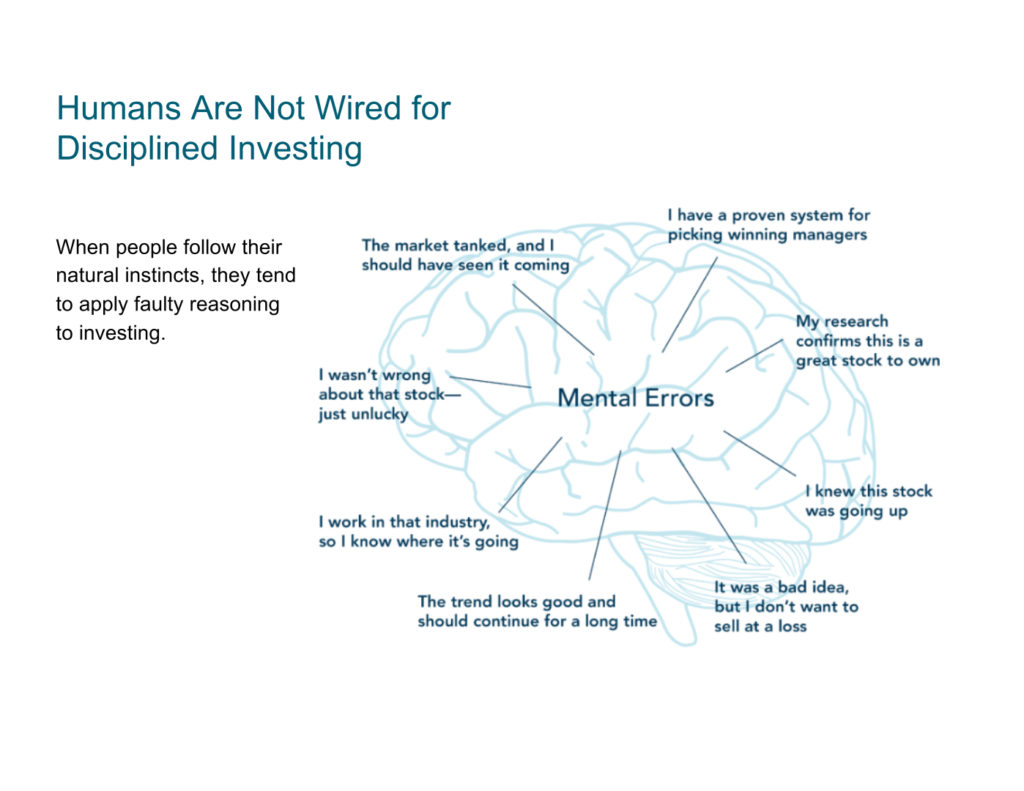

How? Remain diversified through disciplined investing according to your pre-determined investment plan. Do not chase or react to markets. Unfortunately, emotions war against our ability to do this. To begin, our brains are not wired for disciplined investing:

Emotions Drive Poor Investment Decisions

This wiring, exacerbated by human emotion (of elation in bull markets and fear in bear markets) results in undisciplined and therefore detrimental investment decisions. Here are 2 common mistakes:

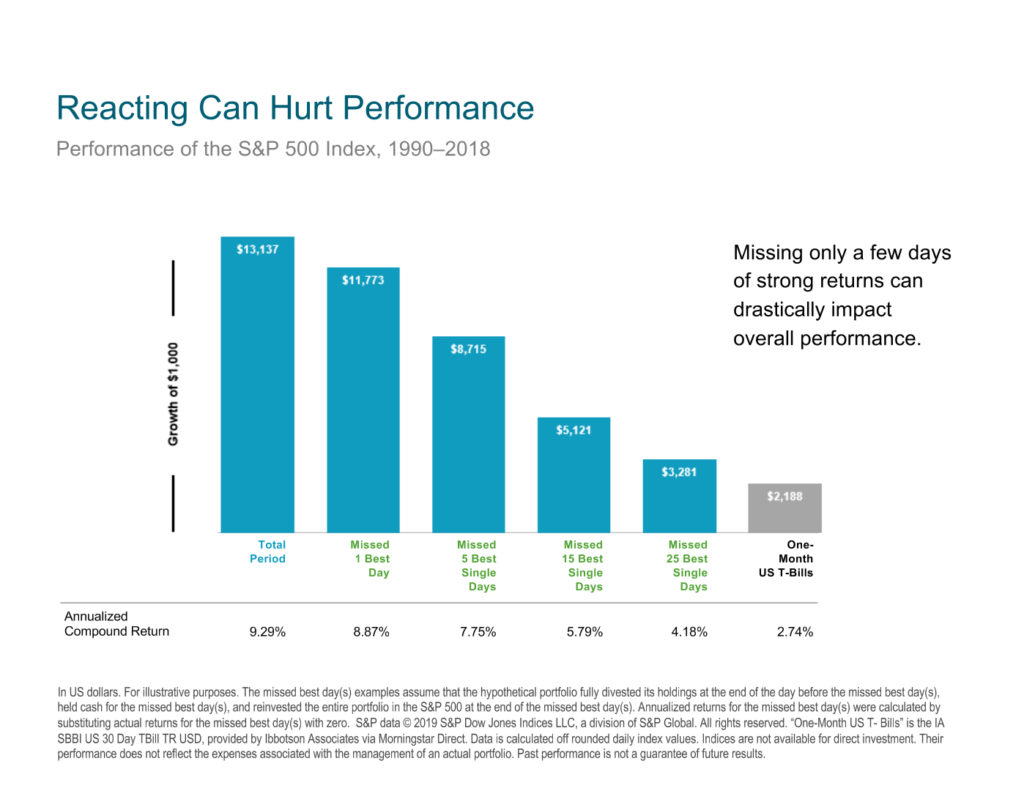

1. Timing the Market. Imagine sitting through a 3-hour soccer game and missing the only goal because you were on a 10-minute bathroom break. Similarly, you can be in the stock market for decades, but missing even a few days of strong returns can drastically impact overall performance.

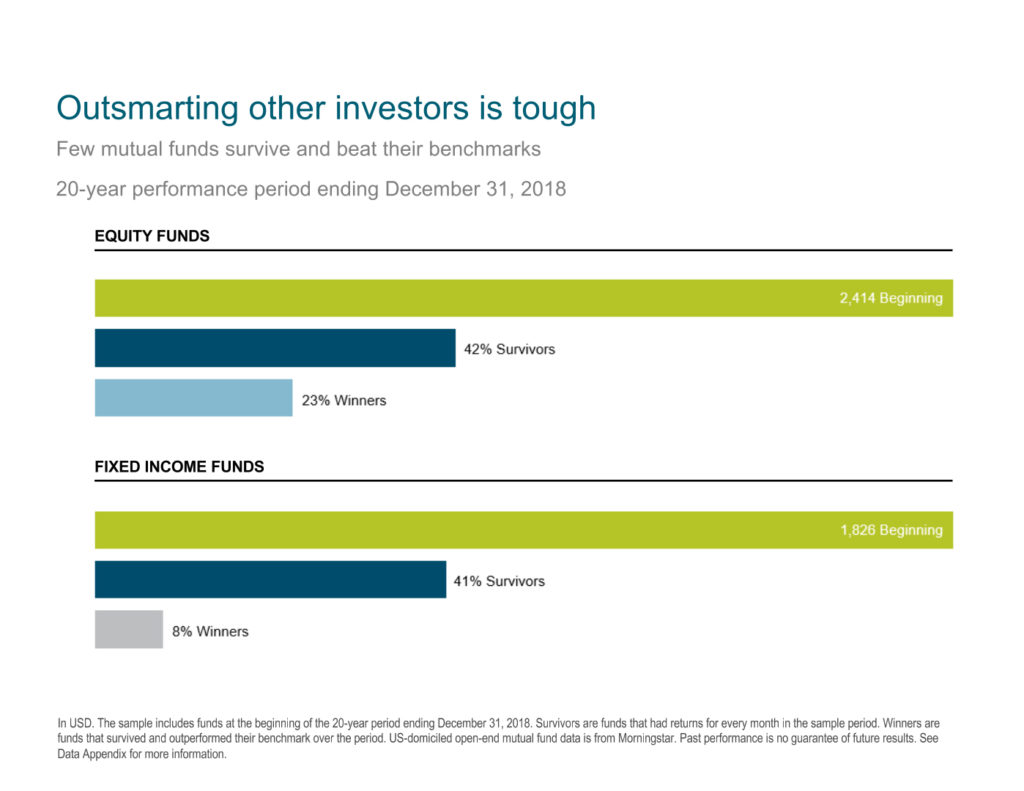

2. Picking Stocks. Although it is possible to bet on “winner” companies, it is rare that investors (and even highly-paid fund managers) can pick winners consistently over long periods of time. As you can see below, only a few equity funds have even survived let alone outperformed their benchmarks:

“Outrun” Investors with Disciplined Investing

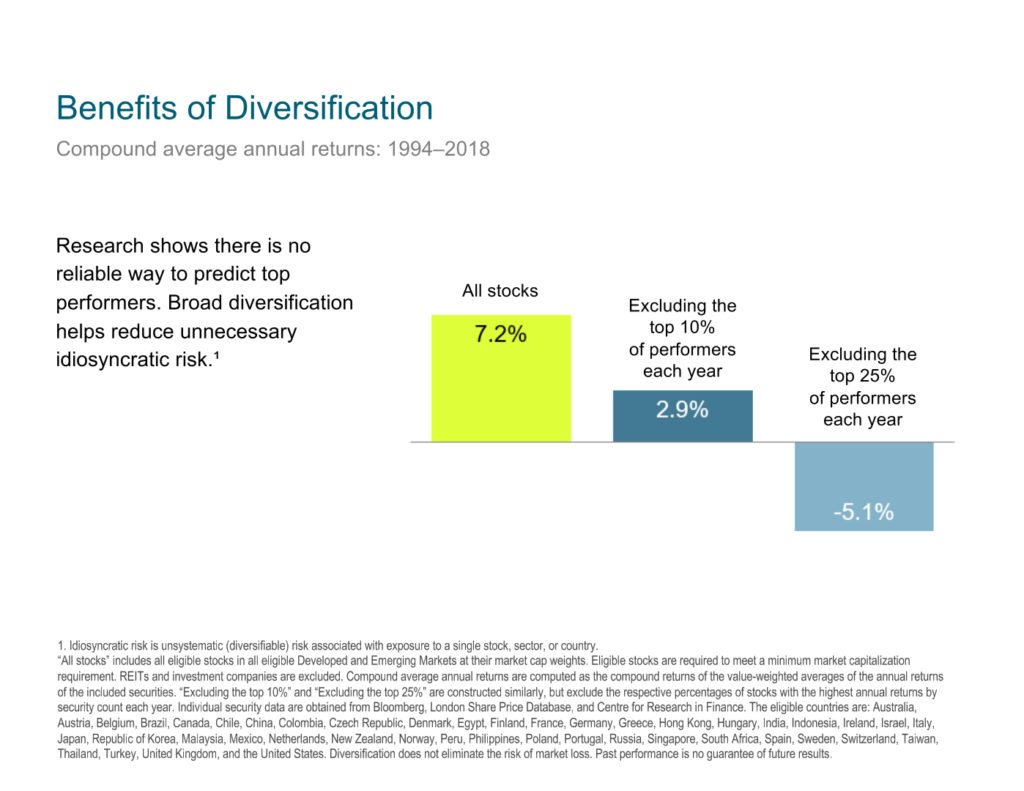

On the other hand, consider the benefits of a long-term, diversified portfolio:

Consider the latest Covid-19 downturn beginning late February 2020. Many investors sold their equity positions at major losses until the Russell 2000 was down 39% YTD and S&P 500 down 25% YTD by late March. But for every investor that sold a stock, there was an opportunistic investor on the other side of the transaction buying that same stock at a discount. This is where our clients are beating the competition. 25 clients “stay the course” buying stocks at a discount with their savings plan and/or extra cash while others stop their savings plans and/or fearfully sell at major losses. We cannot avoid the bear markets, but we can “outrun” other investors by remaining disciplined. Our recommendation: stay the course. Contact us to learn how.