Financial Planning basics for our Kids and Community

Written by: Randy Larson, J.D., LL.M., CFP®

Financial Planning basics for our Kids and Community

Should I open a Roth for my kids? Can you tell me some investing basics to get them started? Would these principles apply to inexperienced investors in my community as well?

Yes, yes and yes! 25 Financials’ Vision is to help you live life to its fullest potential. Helping others is part of living life to the fullest – as the Proverb states, “Refresh others, and you yourself will be refreshed.” Teaching others to create ecosystems of financial health creates compound interest that can be life-changing, even multi-generationally. You can be this life-changing agent in someone’s life.

Just last month, I shared the basics outlined below with a young man at my church. Up until that point, he lived paycheck to paycheck. He told me last week that he is now in the habit of saving every week in his investment accounts. It has even become a game for him to see how much he can sock away each month!

Let’s look at a few general principles and then practically, how to open accounts.

General Principles

My ten-year-old is a big spender – whether buying birthday gifts for siblings or a fish tank for his room. When he asked to tap into his savings account to buy a toy, I knew it was time to have the financial talk. Cravings for more do not subside as we get older – the price tag just goes up! We must modify our behavior to be content. And the longer we wait, the more difficult it becomes to form new habits.

I explained to my son that it will never be easier for him to save than right now. After paying for food, housing, taxes, etc…as an adult, there is not much left over to spend! Earning $5/hour now is like earning $25/hr as an adult.

We agreed that for every 10 dollars he earns, he will donate 2 dollars to charity, save 2 dollars, then he can spend the other 6 however he wants. Our older 2 children (16 and 15) have saved and donated thousands so far. As importantly, they have learned to be content living on 60% of their income.

The day will never come when we feel like we have enough to comfortably give to charity or begin a savings habit. Like most healthy habits in life, this is one where we must act our way into proper feelings and not try to feel our way into proper actions.

My ten-year-old son worked an extra job around the house to buy the toy. It only took him a week for his desires and lifestyle to conform to his healthy habits of saving and giving. 55% of Americans live paycheck to paycheck. Imagine if they had developed healthy habits at a young age. Let’s give that opportunity to those around us!

Practical Next Steps

There are several custodians you can use to invest. I included steps to open Schwab accounts. This is who I use for my kids.

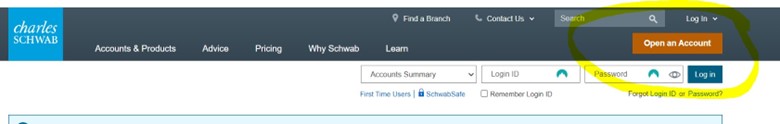

1. Go to “Open Account” on Schwab.com.

2. Choose and open account. It should take around 10 minutes to open each account. All 5 of my children have Custodial brokerage accounts and my older 3 have Roth IRAs.

You must have “earned income” to fund a Roth IRA. My older three children use money from chores around the house and income from small businesses they created (selling chopped wood, chicken eggs, etc…) to fund their Roth IRAs. The primary advantage of a Roth IRA is that all the growth is tax-free.

I told my 15-year-old that if he makes a one-time contribution of the maximum Roth limit of $7,000 this year and earns 8% per year in the market, he will have $206,891.80, net of taxes by age 60. Even adjusted for inflation, this is more than most Americans retire with right now – all from just one investment! Of course, Roth IRA rules require him to wait until age 59 ½ to withdraw this money.

The brokerage account investments, on the other hand, can be withdrawn anytime without penalty, but you must pay taxes on investment gains. Most will want to open an individual brokerage account if single or a joint brokerage if married. For a child under the age of 19 (or a full-time college student under the age of 24), many will open a “Custodial Account” account where the first $2,600 of a child’s unearned income is tax-free.

Click “all accounts” on Schwab.com to see full selection of accounts.

3. Transfer money into the account. Once each account is open, you can link a checking account to each Schwab account. This will allow you to draft money into the accounts. Most people choose a monthly draft where the funds will be automatically drafted and invested.

4. Invest inside the account. Many will choose to invest in a “target date” fund. This is one fund that is a diversified mix of many stocks and bonds. It automatically rebalances itself and becomes more conservative as the target date (of withdrawal) nears.

For example, my children’s Roth IRAs are invested in a “2065 target date” fund because it will be withdrawn at their retirement, around 2065. But their brokerage accounts are invested in a “2030 target date” fund because they plan to use that money sooner (downpayment on a house, car, etc…).