4 Reasons Physicians And High Net Worth Investors Should Consider Alternative Investment Funds in Their Portfolio

Written by: Randy Larson, J.D., LL.M., CFP®

With recent market events, many Doctors are asking, “Should I consider alternative investment funds in my financial portfolio?” In 2008-09, Physicians in even moderate stock and bond portfolios lost a quarter of their investable net worth in a matter of months.1 In 2020, that loss took only a few weeks. Even with a steep market rebound, it can take years for a portfolio to reach the prior-to-downturn values.2 The financial and emotional toll this dramatic loss of hard-earned dollars elicits is hard to calculate especially when Doctors are nearing retirement while simultaneously losing a portion or all of their income due to Covid-19.

At this point, disciplined investing goes out the window and the “buy gold” commercials begin to look appealing! Some Physicians and Dentists even consider the cumbersome and risky prospects of buying real estate and becoming landlords. Of course, most Doctors will get busy again, suffer paralysis from analysis, and do nothing. The result is a stockpiling of hundreds of thousands and millions in CDs, money markets and savings accounts (all currently earning less than the rate of inflation). But anything is better than watching your worst financial nightmare unfold in a matter of weeks, beholden solely to the stock and bond market.

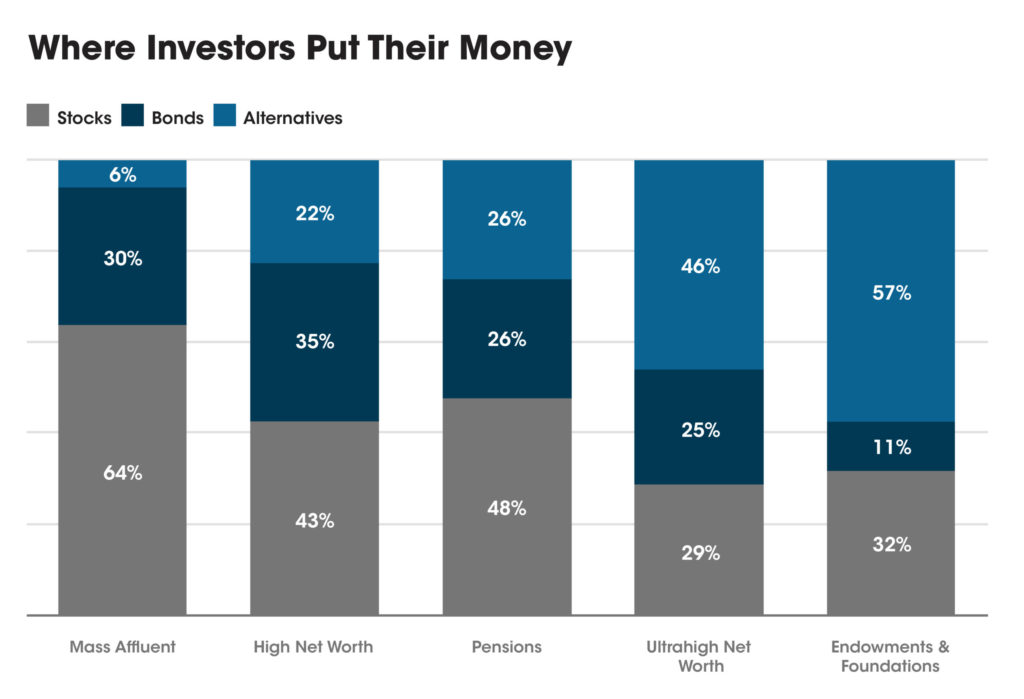

Is there another way? Figure 1 illustrates that many Ultrahigh Net Worth3 investors and Trustees of Endowments and Foundations seem to think so. In fact, many Foundations and Endowments have allocated over half of their assets outside of the traditional stock and bond market into “alternative investment funds” the since the 1980s with retail investors catching on around 20 years ago.4

What Is An Alternative Investment?

Alternative investments can be defined as investments that do not fall in the traditional categories of stocks, bonds or cash. Some common examples are private equity5 or venture capital6, hedge funds7, limited partnerships, commodities and real estate. Most alternatives are illiquid, not regulated by the SEC and only accessible to accredited investors as defined in figure 2. For these reasons, alternative investment funds may carry more risk and should be vetted carefully before investing. Investors should partner with an experienced due diligence and compliance team before participating in alternative investment funds.

4 Reasons to Consider Alternative Investment Funds

Dwindling Public Market vs Growing Private Market

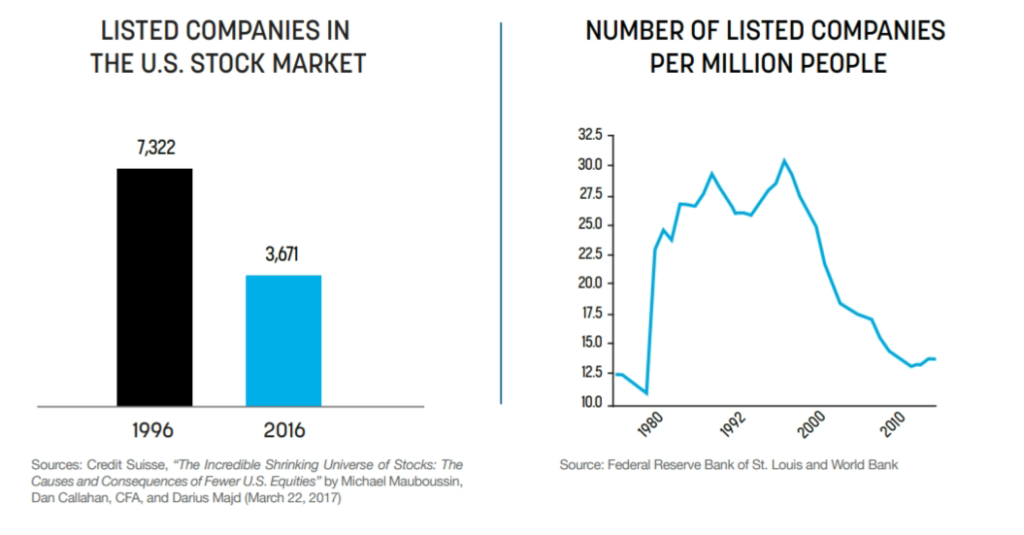

There are far fewer publicly listed companies in the U.S. today than there were in the mid-1970’s8, despite the fact that the GDP is three times larger now than it was then.9 This is in large part due to the 50% drop in publicly listed companies in the U.S. from 1996 to 2016 as shown in figure 3a. This drop is a result of an increase in mergers and acquisitions and decrease of IPOs over the last 20 years. Companies are also choosing to stay private for many reasons including the compliance and regulatory costs of being public. As indicated in figure 3b, this results in a much more crowded space for investors who, for example, rushed to invest close to $8 trillion in the S&P index alone in 2017.10

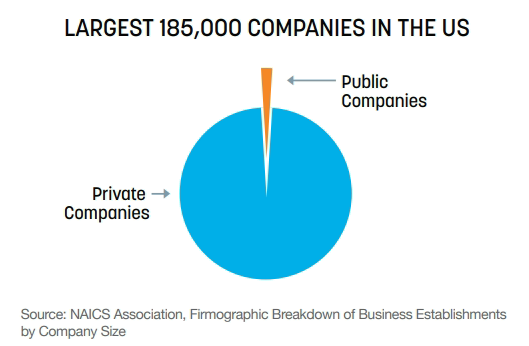

In contrast, there are millions of private companies and yet only $2.8 trillion under management in the entire private equity industry in the same year.11 In fact, as figure 4 indicates, only a fraction of the largest 185,000 companies in the U.S. are public companies.12

In light of the vast number of private companies, and the increased funding towards a dwindling number of U.S. public companies, the principles of diversification would suggest considering allocating at least a portion of an accredited investor’s portfolio toward private companies. And yet, according to one study, alternative investments only account for 7.2% of wealth manager’s assets under management in 2017.13 This is in part because, unlike Physicians, only around 10% of U.S. investors are accredited and do not have access to most alternative investments. Many wealth management companies cannot allocate adequate resources to build the necessary due diligence platform for such a small fraction of their client base and therefore choose to avoid alternative investments altogether. The result is that their clients cannot exit the volatile and competitive “red ocean” of stocks and bonds and explore the “blue ocean” of alternative investments alongside low cost index funds.

Diversification Through Non-Correlation

The goal of diversification is to reduce volatility over time and therefore increase the investors’ potential return. A common strategy to decrease volatility in a portfolio is investing in non-correlated assets. Non-correlated or negatively correlated assets do not move in tandem with each other and might move in opposite directions under a variety of market conditions. Holding non-correlated assets reduces volatility in a portfolio as an asset on the rise may offset another asset’s declining returns.

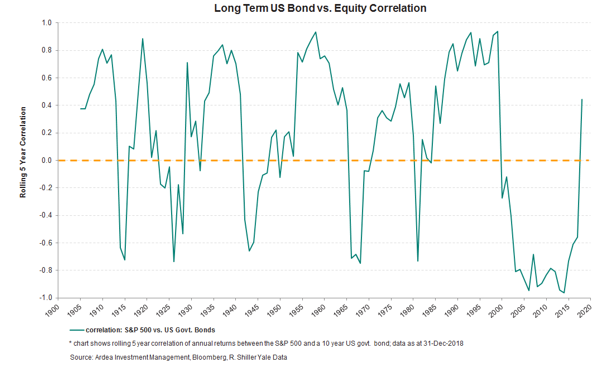

Many investors hold bonds in hopes that they will be negatively correlated to their stocks. But as figure 5 illustrates, there are decades with high correlation between stocks and bonds resulting in less diversification and greater volatility in a stock and bond portfolio.

Alternative investments, on the other hand, are consistently non-correlated with stocks and bonds. When the Dow Jones declined by 28% in 4 weeks this year,14 it does not predict what will happen to non-correlated alternative investments in that same timeframe. Diversifying into non-correlated alternative investment asset classes can at the least shelter a portion of your portfolio from market crashes and might even offset losses with gains.

Out-Performance

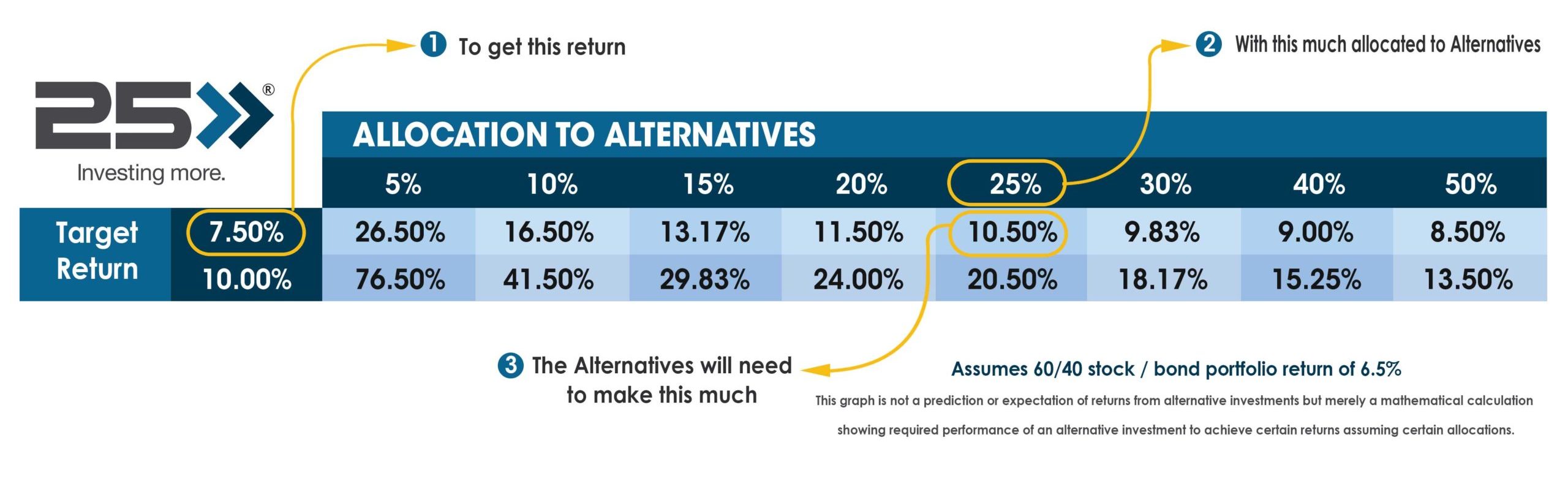

Physicians often do not have the luxury of investing in lower performing portfolios if they want to reach their goals. Unlike other professionals, Physicians usually do not begin to invest until their mid-30’s and also need larger retirement incomes to keep pace with their in-practice lifestyles. This requires “racehorses” alongside “workhorses” in their portfolios. But, as figure 6 indicates, the smaller the allocation towards alternative investments fund, the higher the return will have to be to achieve your target portfolio return.

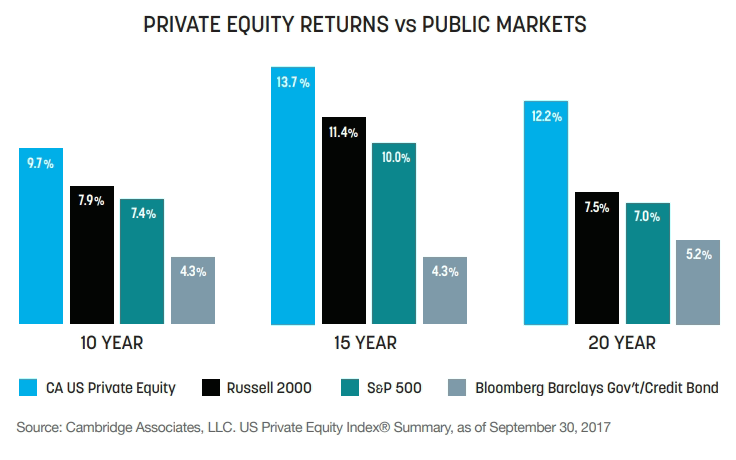

As figure 7 indicates, private market performance has the potential to outpace public markets over time. One fundamental reason is the legal use of “insider information.” Public companies are well researched, stock prices quickly reflect new data that is accessible to everyone and news spreads in seconds. This is not the case with private companies. Consider a hypothetical real estate opportunity in the expanding downtown Phoenix, AZ market. Of the six high-rise luxury condominiums being built, you discover that one has been awarded a $4M tax credit. This is a factor that is not well-publicized but would be “insider information” that is important in your decision to invest. There are hundreds of factors to consider when considering private investments and unlikely that you will obtain and stay apprised of the necessary information to make well-informed decisions. It is important to have an experienced due diligence, compliance, and advisory team to help vet companies that have a proven track record and access to more information in their sector than the general public. Beware of advisors that solicit money from clients to invest in their own company’s alternative investments. There can be hidden fees and significant conflicts of interest. Choose a due diligence and advisory team that demands and displays transparency of fees from all parties.

[bctt tweet=”Beware of advisors that solicit money from clients to invest in their own company’s alternative investments. There can be hidden fees and significant conflicts of interest.” username=”25financial”]

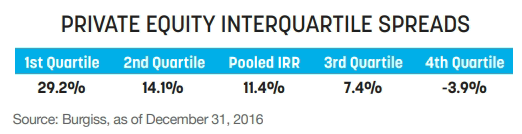

The level of due diligence required is beyond the expertise and time that most physicians and high net worth investors can offer. In fact, even fund managers have a varying degree of success. As Figure 8 indicates, the spread between top and bottom managers in private equity, for example, is massive. Investing in private markets without a high-quality due diligence and compliance team can be detrimental. On the other hand, with an experienced team, physicians and high net-worth investors can reach their goals more efficiently and with potentially less overall risk.

Tax Strategies

Physicians are always on the prowl for creative ways to decrease their tax liability. Alternative investment funds can offer many solutions including the Intangible Drilling Cost (IDC) deduction under IRC Section 263(c). Investors in oil or natural gas drilling partnerships are able to expense in the first year of drilling, any costs that do not have salvage value (like fuel and rig rentals, drilling crews, etc…). Some companies offer a deduction of 80% of the original investment in the first year. IDC deductions are “above the line” and therefore reductions of the Physicians’ active income.

For example, if a Physician invests $100k in a natural gas limited partnership with 80% IDC deductions, they will receive a K-1 from the partnership showing an $80k above the line loss in the year of investment. If the Doctor makes $600,000 total income, they will be taxed as if they only made $520,000. At a 40% effective tax rate, this will save 32k in taxes that year. These strategies are particularly powerful when a Physician sells their practice and incurs large gains in the year of sale.

1 “Investors in a 60/40 portfolio lost 20% on a monthly basis only four times in the last 75 years including 2020. These were all within months of the trough of major bear markets, where a low was yet to come. The other three instances were in 1974, 2002, and 2009 and it took between 10-20 months for a 60/40 portfolio to recover.” https://www.cnbc.com/2020/03/

2 For example, the once 1M portfolio is now worth 750k and a 250k gain (to reach 1M) is much more difficult to reach from 750k than starting from 1M.

3 The high-net-worth club is usually around $1 million in liquid financial assets. The upper end of HNWI is around $5 million, at which point the client is then referred to as “very HNWI.” More than $30 million in wealth classifies a person as “ultra HNWI.” https://www.investopedia.com/

4 “Since 2000 private equity, private credit, and hedge funds have surged from just a trillion dollars combined to $8.3 trillion, compounding assets at roughly 11 percent per annum. And by 2023, Preqin forecasts that alternatives will hit $14 trillion in total.” https://www.

5 Private equity is generally comprised of a combination of investors and funds that make investments into private companies to fund new technology or products, expand product suites within an owned company, make acquisitions or to buy out public companies (converting them to privately held companies).

6 Venture capital is a subset of private equity that specializes in investing in the early, or growth phase, of a company. These investments tend to be more risky.

7 Hedge funds are privately offered investment funds created by combining the capital of multiple investors to invest in securities and other financial assets. Hedge funds often employ hedging and techniques using long and short positions, leverage and derivatives and investments in multiple foreign and domestic markets, with the goal of generating high returns.

8 When the Wilshire 5000 Total Market Index was established to capture the 5,000 or so stocks with readily available price data.

9 Interestingly, listings in other developed countries rose 50% in the same time period. https://research-doc.credit-

10 S&P Dow Jones Indices, February 28, 2018

11 2018 Preqin Global Private Equity and Venture Capital Report

12 In response, some analysts focus on the value or market concentration of publicly listed companies (rather than the number of listed U.S. companies) arguing that public market investors can still participate in the growth of the U.S. economy. But this does not negate that accredited investors should consider both private and public companies to remain diversified. Sources: https://personal.vanguard.com/

13 https://www.fa-mag.com/news/

Important Information:

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purposes of making an investment decision or otherwise. 25 and Great Point Capital, LLC are not tax professionals. You should consult with your tax professional before taking actions which affect your tax situation

Securities offered through Great Point Capital, LLC, member FINRA, SIPC and NFA. Investment advisory services offered through 25, LLC, an SEC Registered Investment Advisor.