Putting 2022’s Market Losses in Perspective

2022 was a year where it seemed like nothing worked. The mighty S&P 500, a benchmark for the US stock market and overall economy, was down 19.44%. US Corporate Bonds, typically considered a “safer” investment by many were also down nearly 15%. In a year marked by stiff economic headwinds, retirement savers paid the price.

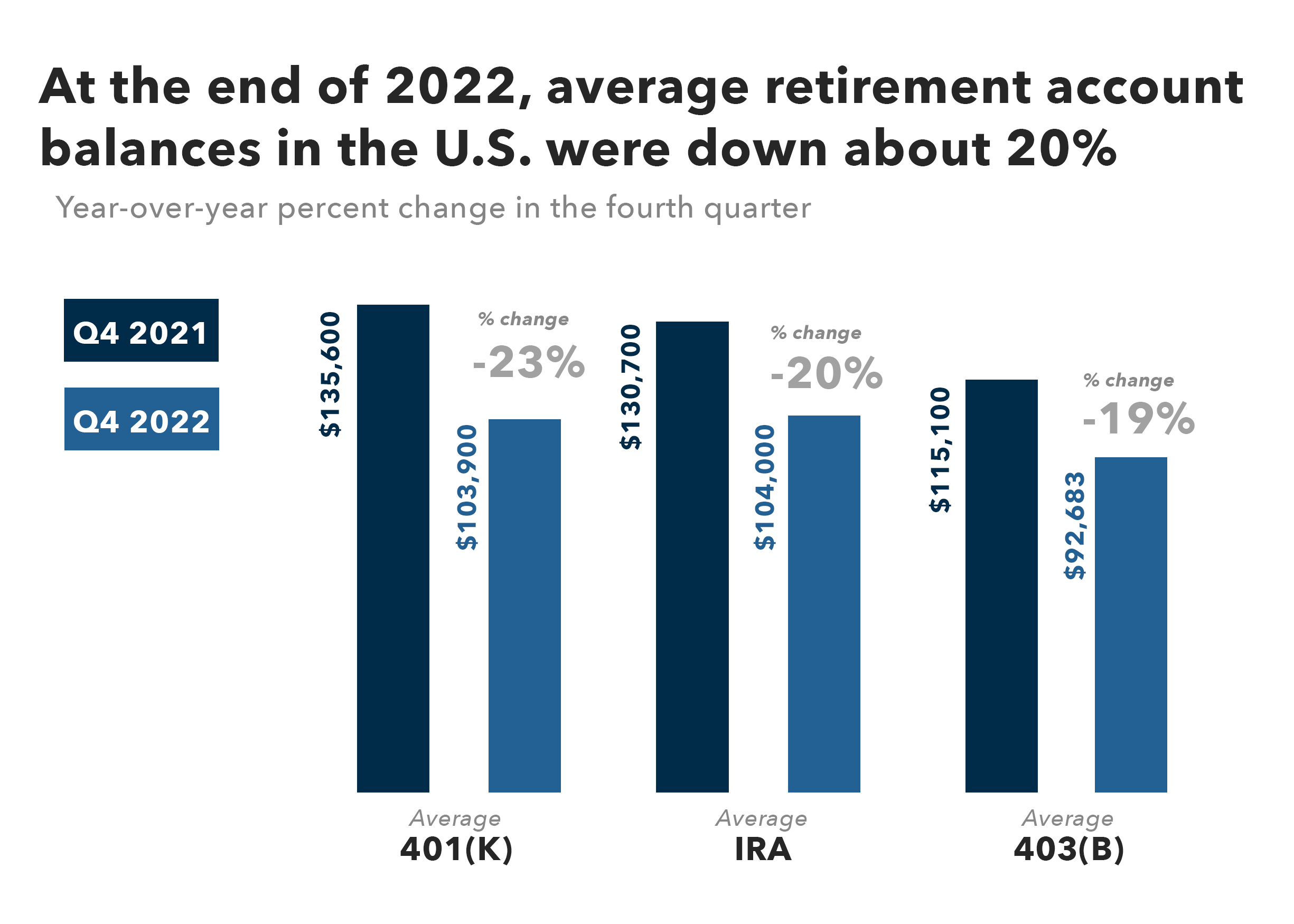

The average 401(k) balance ended 2022 down 23% from a year earlier to $103,900, according to a new report by Fidelity Investments, the nation’s largest provider of 401(k) plans. The financial services firm handles more than 35 million retirement accounts in total.

The average individual retirement account balance also plunged 20% year over year to $104,000 in the fourth quarter of 2022.

Past performance is not indicative of future results.

A separate analysis from Vanguard also found that average 401(k) balances fell 20% in 2022 to $112,572, and hardship withdrawals ticked up slightly.

Finding the roses among the thorns

Despite the significant losses felt by most investors in 2022, there were a few sectors that outperformed on a relative basis. Vanguard’s Total International Stock Market Index, which tracks ex-US public companies was down only 16%. Small caps also outperformed large caps on a relative basis, and value stocks tended to significantly outperform growth stocks.

2022 Highlights the Importance of Diversification – in Traditional and Alternative Asset Classes. Long-term investing requires discipline and a sound financial plan in place before the market goes through downturns. Our clients invest in a broad range of asset classes. We aren’t trying to find the needle in the haystack, rather we invest in the haystack. Investing in small and large, value and growth, international and domestic allows in a properly weighted plan helps to mitigate the concentration risks of picking the “wrong” stocks or bonds.

Past performance is not indicative of future results.

In addition, our alternative investment offerings have returns that are uncorrelated to the public markets, which can also potentially serve as a stabilizing force in a well-diversified portfolio during years like we saw in 2022.

If there’s one thing to remember in these volatile years, it’s to not panic. Warren Buffett recently wrote in his famous annual letter to shareholders: “The world is full of foolish gamblers, and they will not do as well as the patient investor.”

At 25, we understand the value of patient investing. We strive to take appropriate risks that gives our clients the potential to flourish over the long run, regardless of the year-to-year behavior of the market.

Further reading on disciplined investing by founding partner Randy Larson: https://25financial.com/outrun-investors-with-disciplined-investing/